From Infinite Upside to Finite Math

Protocols turned on fees so markets stopped pricing imagination and started pricing rights, and tokens have almost none.

Let’s open with a bit of wisdom from one of the greatest contemporary philosophers of our time: Russ Hanneman (from the show Silicon Valley).

In the show, there is a scene where Russ screams at Richard Hendricks for trying to generate revenue. His logic is flawless and, unfortunately, exactly where crypto is today:

“If you show revenue, people will ask ‘HOW MUCH?’ and it will never be enough. The company that was the 100xer, the 1,000xer, is suddenly the 2x dog. But if you have NO revenue, you can say you’re pre-revenue. You’re a potential pure play.

It’s not about how much you earn, it’s about how much you’re worth. And who is worth the most? Companies that lose money!”

For the last year, we’ve finally come to terms with the “Revenue Meta.” We demanded protocols turn on fee switches and real yield.

But… we forgot the second half of Russ’s warning. Once you have revenue, you have a price tag

When a protocol was a “governance token” with zero earnings, we could value it at $10 billion based on “future global adoption” and “monetary premium.” But the moment that protocol makes $10 million a year in fees, the math changes. The market looks at it and says, “Okay, $10M revenue... let’s give it a generous 30x multiple... congratulations, you are now worth $300 million.”

Once fees exist, markets stop pricing imagination and start pricing rights. And tokens currently have almost none.

Infinite potential to finite math.

“Buybacks don’t work when the token has no terminal rights.

This is why we just saw Helium ($22m ARR*/ $352m FDV) and Jupiter ($117m ARR*/ $1.473bn FDV), openly questioning whether buying back their own tokens actually works.

Both these projects are ‘down and to the right’, and while it is true they bought millions of tokens, they also had billions of token unlocks across the same period.

Buying back your own token when you are effectively ‘pre PMF’ is like peeing against the wind, you’re going to get wet. You are burning treasury cash to prop up a price that the P/E ratio doesn't support anyway. And in vast majority of cases, you’d be much better spending that money on growing further.

Unless there is something else justifying that premium….

The Great Disconnect

Tokens are designed to absorb risk with limited upside capture

The deeper problem is what we actually own. Right now, there is a massive misalignment in the capital stack. In a typical crypto project, the founders and VCs hold two things:

Equity: Ownership in the Labs company (the legal entity, the IP, the bank accounts).

Tokens: The liquid asset trading on exchanges

The public? They usually only hold the Token, which in its current form is a very reflexive narrative chip.

This was fine when the “utility” narrative held up. But now market is both maturing and filled with sophisticated actors. Within a quick glance, they realize the token is an abstraction with a vague claim on "network success."

This is the very painful lesson that Axelar, Vector, and Vertex token holders learned this past year when they received pretty much nothing in the acquisitions.

The “Gensler Purgatory.”

Why haven’t we fixed this? In one word, Gary, in two, Gary Gensler.

The SEC regulatory freeze has forced us to keep these two worlds separate. We structurally can’t give give tokens dividend rights, liquidation preferences, or voting power over actual things beyond kumbaya governance as it will instantly mark them as securities in a hostile regime.

But soon™ we will have clarity (pun intended) for tokens with the Digital Asset Market Clarity Act. It is expected to clear the Senate in early 2026, and will finally provide a framework that will allow crypto companies to propose actual solutions without going to jail.

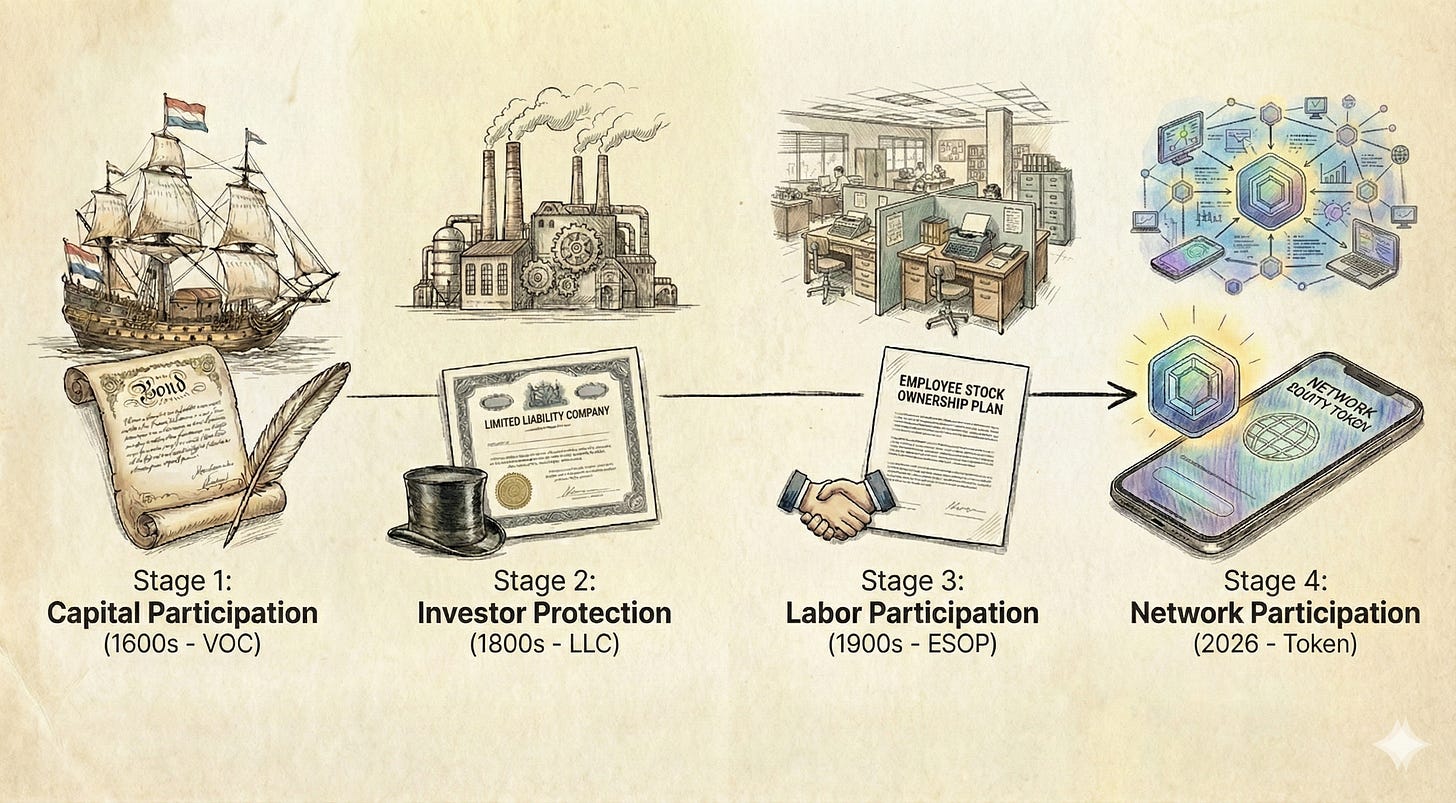

400 year Arc: From Nuts to Networks

To see the way out, we zoom out.

Tokens are the next step in a 400 year evolution of human incentive alignment. The inevitable fourth stage of the (network) corporation.

Short history circuit

The Share (Capital Participation): In 1602, the Dutch East India Company (VOC) needed massive amounts of money to build ships, sail to Indonesia, commit atrocities, and secure a monopoly on nutmeg and other spices. They couldn’t fund this alone, so they they issued the first publicly traded shares. This allowed the public (aristocracy) to put up capital in exchange for a share of the plunder.

The Innovation: Capital Participation.

The LLC (Investor Protection): Fast forward to the 19th century. Industrial ventures and risks grew exponentially. If a company went bust or committed atrocities, investors could be held personally liable for everything they owned. To solve this, we invented the Limited Liability Company (LLC). A legal "corporate veil" to protect capital providers from personal ruin. (This was a part of numerous legal innovations of the time)

The Innovation: Investor Protection.

The ESOP (Labor Participation): By the early 1900s, Industrialization peaked, and the world realized that if the people doing the work care about the outcome, it becomes a much better one. Companies like Sears and P&G began pioneering stock ownership plans, eventually formalized into the ESOP (Employee Stock Ownership Plan). Employees got a share of the upside.

The Innovation: Labor Participation.

The Token (Network Participation): This is where we are now. Since the 2000s the largest companies are actually networks. These networks depend on users, curators, and early believers to function. Tokens promise us to finally give the participants of the network, a share in its success.

The Innovation: Network Participation.

"Airbnb believes that twenty-first century companies are most successful when the interests of all stakeholders are aligned, For sharing economy companies like Airbnb, this includes our employees and investors, but also the hosts who use our marketplace."

- Brian Chesky, Airbnb CEO, when he tried (and was refused by the SEC) to allocate shares to Airbnb Hosts.

The path is clear, capitalism aligns value creation maxxing by increasing the ownership surface.

The New Reality

The “Liquidity / global / permissionless Premium” of the last cycles is over. The era where we could value a protocol at 100x earnings because “crypto is different” is done.

The valuation coming collapse is the labor pain from a birth of a new asset class. The market is forcing a convergence on reality. If a token is a claim on the network, it must have the rights of ownership.

Here we have lighter team doing pretty much that.

The only way out of the “Russ Hanneman Trap” is to leverage the regulatory clarity, produce economic value, and merge the two worlds. The token must become the equity equivalent. Representing actual ownership and a legal claim on the success of the network itself.

Counter argument: Maybe Tokens are not Equity

I might be diagnosing the wrong disease? Some of the most successful crypto projects have already solved this problem, by separating tokens from ownership in the first place.

The L2 playbook. Arbitrum, Optimism, and Starknet have tokens with separate functions from the equity.

Token: Network gas, governance over protocol parameters, ecosystem incentives.

Equity: Traditional cap table, held by the Labs with actual claims on the company’s balance sheet

Maybe tokens and equity solve different problems. Equity is a claim on a legal entity’s cash flows and assets. A token trying to somehow enforce those same rights across a permissionless, pseudonymous, global network… simply might not work. Good luck with that.

The Bifurcation

What will likely happen is a split in the asset class:

Commodities (L2s/L1s): If you are Ethereum or Arbitrum, you are selling digital oil (blockspace). You don’t need to offer dividends because the commodity itself has utility. The value capture is the demand for the resource.

Businesses (DeFi/Apps): If you are a DEX, a lending Protocol, or a prrps dex, you are not selling oil. You are a service business generating cash flow.

If you are a business pretending to be a commodity, the market will punish you. You cannot ask for a tech growth valuation (equity) while offering only the rights of a utility coupon (commodity).

For the L2s, the “Gas Model” works. But for the 90% of the market building applications including Jupiter, the Helium, and Uniswap, there is no hiding place. You are a business. And in the history of capitalism, there is only one way to align a business with its owners: Equity.

We are done larping. Welcome to the next iteration of equity.

*Total fees paid by users when using the protocol in the last 30 days, multiplied by 12 to annualize it per DefiLlama